McMaster surpasses targets for carbon reduction investments

McMaster has surpassed its carbon reduction targets for its investment portfolio a full two years ahead of schedule.

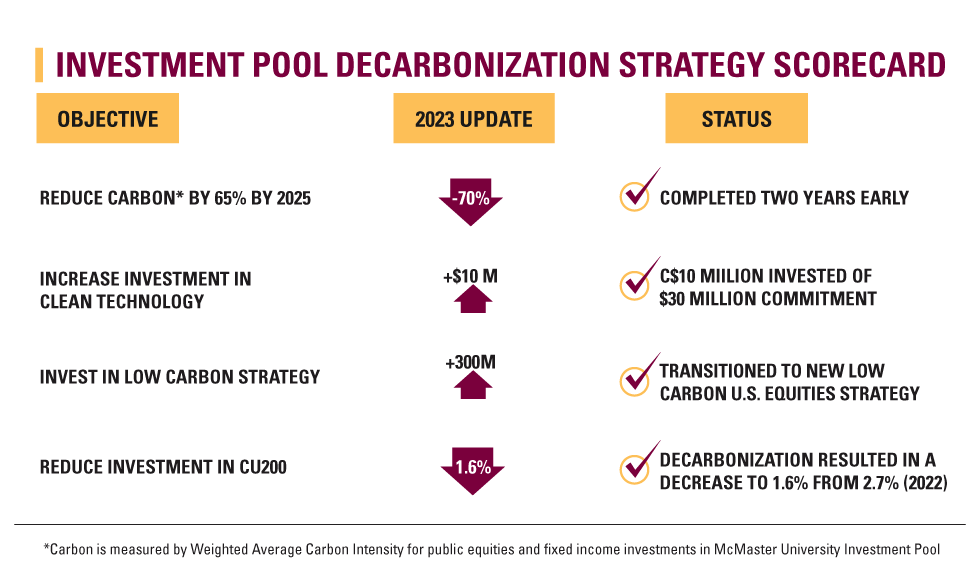

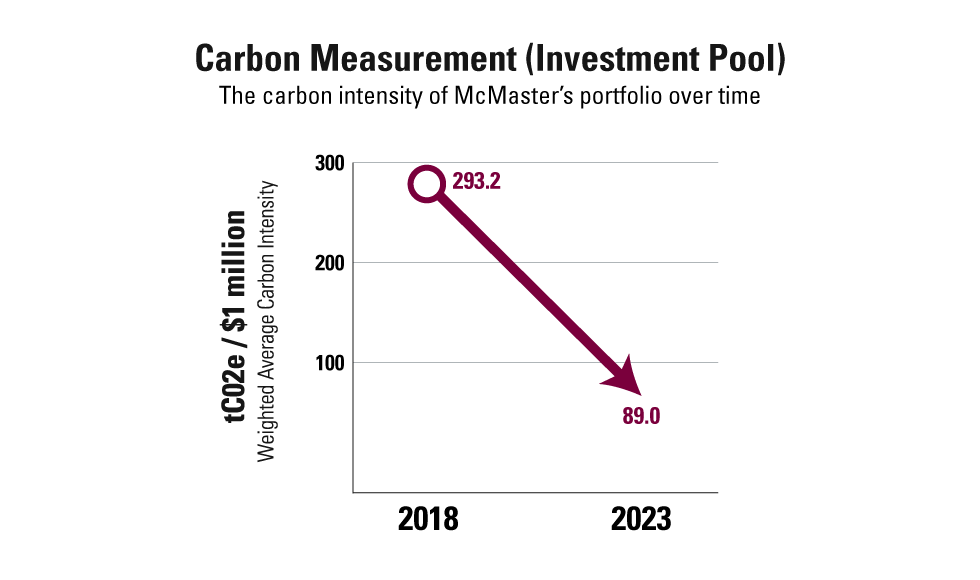

As outlined in this year’s Annual Financial Report, the university has successfully reduced the carbon intensity of its investments by 70 per cent from 2018 levels, surpassing its original goal of 65 per cent by 2025.

To achieve this goal, McMaster takes a holistic approach and reviews the amount of carbon exposure across all of its investments, not just those related to oil and gas. This decarbonization approach of investing in companies that have lower carbon exposure or are actively supporting the transition to a low-carbon economy ensures the greatest environmental impact.

Over the past five years, in addition to transitioning to low-carbon investments, McMaster has divested from higher-carbon holdings, which has resulted in a decrease in its holdings in the Carbon Underground 200 (CU200) to 1.6 per cent from 2.7 per cent last year.

“This is a significant milestone toward our goal of drastically reducing the carbon exposure of our investments,” says McMaster President David Farrar.

“We take our responsibility of fighting climate change seriously and continue to find ways to accelerate the decarbonization of our investment portfolio in a comprehensive, sustainable and financially responsible way.”

In another proactive move, McMaster has invested $10 million in a global fund which only invests in infrastructure such as wind and solar projects. This investment will grow to $30 million over the coming years.

“I’m proud that McMaster has surpassed our responsible investing goals while continuing to ensure the university stays financially responsible,” says Saher Fazilat, Vice-President (Operations and Finance). “McMaster continues to also be an important investor voice pushing companies to transition to clean and renewable energy as soon as possible.”

McMaster’s approach to divesting and decarbonizing its investments in carbon-emitting companies is three-pronged:

- Reduce investments in carbon-emitting companies: Continue to accelerate divestments in any fossil fuel holding company that fails to address the university’s carbon reduction milestones.

- Invest responsibly: McMaster’s investment managers regularly evaluate our investments to ensure they are aligned with our environmental, social and governance (ESG) considerations and international standards, including the United Nations’ Sustainable Development Goals, and the Paris Agreement’s net zero targets.

- Work in partnership to keep companies accountable: McMaster is using its voice to advocate for companies to reduce their carbon footprint. The university is part of the University Network for Investor Engagement, an advocacy and engagement group focused on increasing company climate commitments, and the Shareholder Association for Research and Education, which helps steward responsible investing.

Read more about our efforts in Responsible Investing and the financial status of the university in the Annual Financial Report