McMaster University is a national leader in investment decarbonization

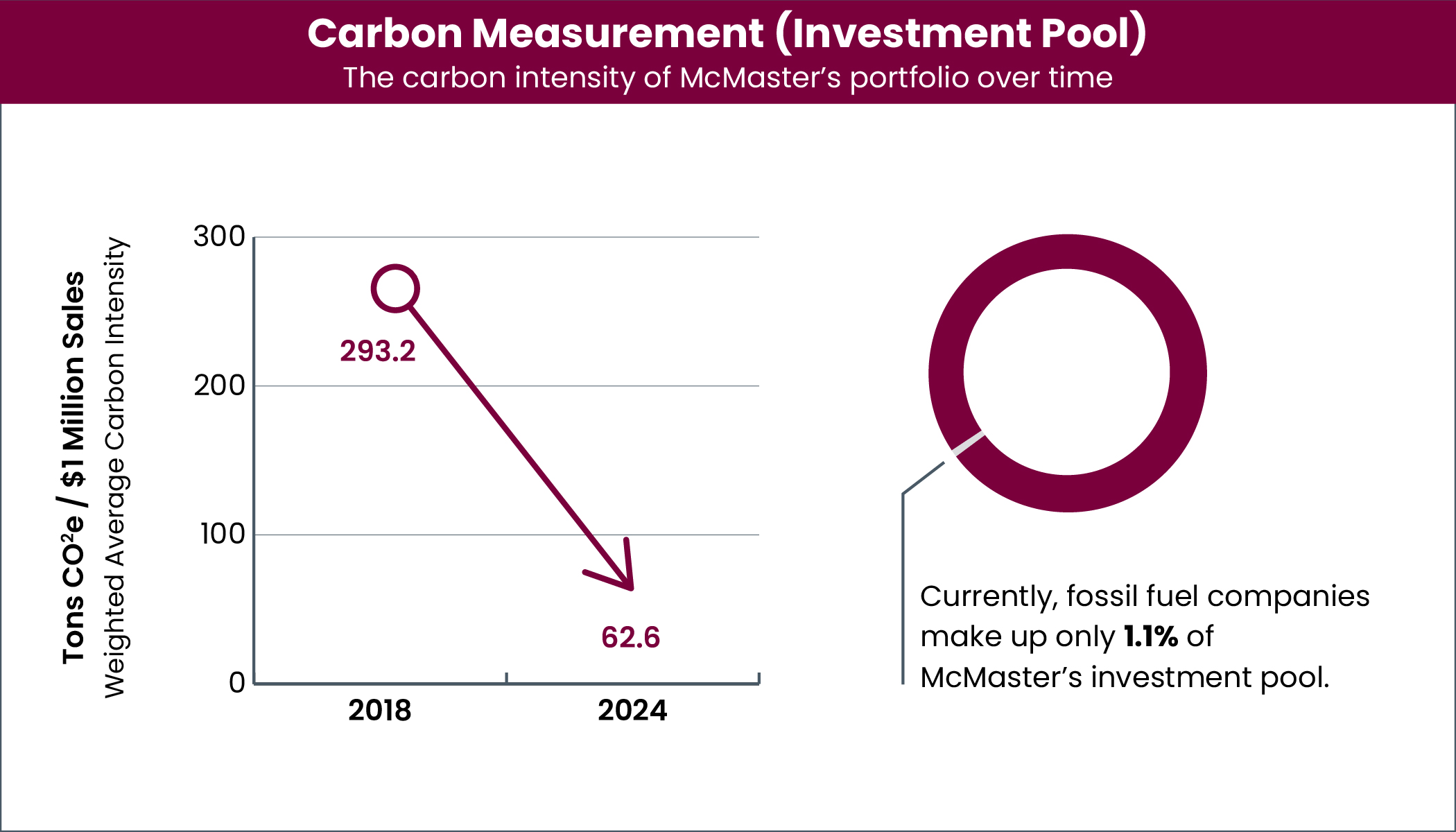

McMaster has reduced the carbon footprint of its investments by close to 79 per cent — six years ahead of the university’s goal of a 75 per cent reduction by 2030.

McMaster has reached its investment decarbonization goal six years ahead of schedule.

The university has reduced the carbon footprint of its investments by close to 79 per cent. That is well ahead of the university’s goal of a 75 per cent reduction by 2030.

The milestone was reached through a strategic rebalancing of the university’s investment pool portfolio over the past six years.

This involved transitioning to more investments in companies with lower carbon footprints or which were actively contributing to the transition to a low-carbon economy, while steadily reducing exposure to high-carbon emitters.

“Everyone can agree that we need cleaner air, safer water and a thriving ecosystem,” says President David Farrar.

“Accelerating our decarbonization efforts while maintaining the strong returns of our investments makes McMaster a national leader in decarbonization.”

Investment Pool Decarbonization Strategy Scorecard |

|

| Objective | 2024 Update |

| Reduce carbon* by 75% by 2030 | Reduced by 78.6% |

| Increase investment in clean technology | Increased investment by $17.2 million |

| Invest in low carbon strategy | $450 million invested |

| Reduce investment in CU200 | CU 200 companies now represent only 1.1% of overall Investment Pool |

| *Carbon is measured by Weighted Average Carbon Intensity for public equities and fixed income investments in McMaster University Investment Pool | |

This progress is part of McMaster’s Responsible Investing strategy.

As a signatory to the United Nations Principles for Responsible Investment (UNPRI) since 2021, McMaster is committed to ensuring that environmental, social and governance (ESG) issues are integrated in its investment decision-making process.

Managing the transition is complex, says Saher Fazilat, vice-president, Operations and Finance.

“Rebalancing our portfolio required ongoing coordination with investment managers, investment strategy development, careful oversight, and considerable time,” Fazilat says.

“Achieving this goal is the result of sustained effort over several years and I want to thank our Treasury’s investment team for its diligent work.”

As a result of reducing the carbon exposure across its investment portfolio, McMaster has further reduced its holdings in the Carbon Underground 200 (CU200) — a list of companies with the largest carbon reserves — to 1.1 per cent of its portfolio, compared to 1.6 per cent in 2023 and 2.7 per cent in 2022.

At the same time, the university also made a significant shift toward clean energy investments, including solar and wind.

McMaster’s approach to decarbonizing its investments is three-pronged:

Reduce investments in carbon-emitting companies: Continue to invest in companies that address carbon reduction milestones or are shifting to a cleaner economy. This includes all investments not just oil and gas.

Invest responsibly: McMaster’s investment managers regularly evaluate our investments to ensure they are aligned with our environmental, social and governance (ESG) considerations and international standards.

Work in partnership to keep companies accountable: The university participates in initiatives like the University Network for Investor Engagement and the Shareholder Association for Research and Education, which focus on promoting climate accountability and responsible investing.